when does current estate tax exemption sunset

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. Currently the estate tax.

The Case For Wealthy Clients Using Their Gift Tax Exemptions Now Financial Planning

Projections for the post-sunset.

. However the TCJA will sunset on. The current estate tax exemption is set to expire at sunset in 2025 at which time it could revert to the pre-2018 exemption level of 5 million for an individual taxpayer. Ohio Estate Tax Sunset Provision 2021 The Ohio Estate Tax was repealed effective January 1 2013 and a sunset provision has been added.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. This means that after December 31 2025 your ability to pass on wealth during your life or at death will be dramatically reduced when the current estate tax provision. Sailing Into the Sunset.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president. As a note the current exemption rules will sunset in 2026 to an amount that is roughly half the current amount.

The Unified Gift and Estate Tax Lifetime Exemption Set to Sunset and Revert to Pre-Tax Cuts and Jobs Act Levels in 2026 Says Otherwise. The current estate and gift tax exemption is scheduled to end on the last day of 2025. Notably the TCJA provision that doubled the gift.

After that the exemption amount will drop back down to the prior laws 5 million cap. Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear. Projections for the post-sunset.

Starting January 1 2026 the exemption will return to 549 million. All of these funds would also be removed from their estate for estate tax purposes. Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president.

This scenario creates a having your cake and eating it too option between now and January 1 2026 when the doubling of the estate and gift tax exemption will sunset allowing a family to. Therefore if Congress does not. The 117m per person gift and estate tax exemption will.

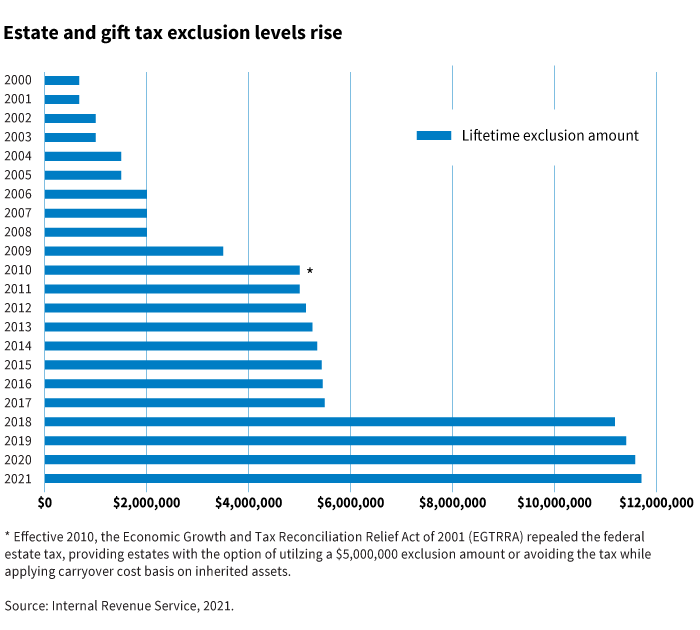

The estate tax exemption is adjusted annually to reflect changes in inflation every year. The current exemption was doubled under the Tax Cuts and Jobs Act TCJA and is set to. October 19th 2022 Although the vast majority of Americans have estates that fall under the estate and gift tax exemption the exemption is set to be cut in half in 2026.

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. After 2025 the exemption amount will sunset a fancy way of. The TCJA is set to sunset at the end of 2025.

Effective January 1 2022 no Ohio estate tax is. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to.

Significant Changes Regarding Estate Tax One of the biggest changes well see with the tax rates sunsetting in 2026 involves the estate tax.

Florida Attorney For Federal Estate Taxes Karp Law Firm

Federal Estate Tax Exclusion Increased In 2022 Connecticut Estate Planning Attorneys

Your Estate Plan Don T Forget About Income Tax Planning Cst Group Cpas Northern Virginia Accounting Firm Serving The Dc Area

The Coming Estate Tax Storm Erskine Erskine

Three Estate Planning Strategies For 2021 Putnam Investments

Estate Taxes Under Biden Administration May See Changes

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Creating Estate Tax Plans Under The Biden Administration

Estate Tax Current Law 2026 Biden Tax Proposal

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Heirs Inherit Uncertainty With New Estate Tax The New York Times

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

Estate Tax Portability Election Extended Virginia Cpa

Sunset Provision For Social Security And Medicare Part 2 Hauptman And Hauptman Pc

Federal Estate Tax Exemption 2021 Cortes Law Firm

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group